IIFL Finance Home Loans: Empowering Homeownership in India

Introduction

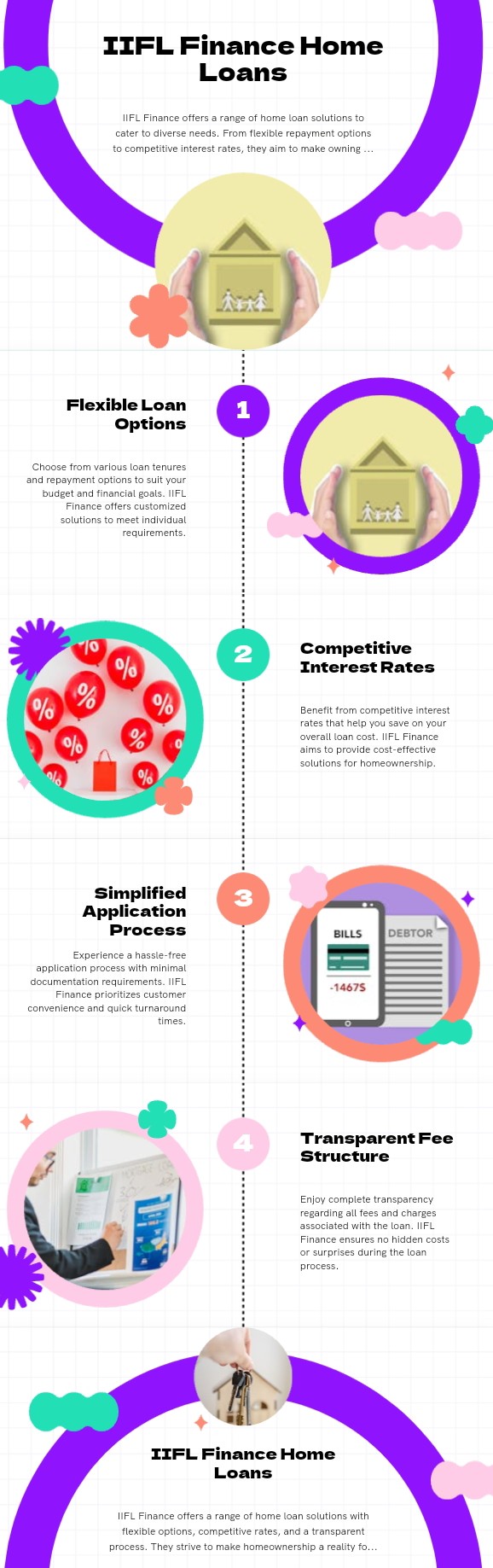

Embodying elegance and sophistication, the realm of homeownership becomes a captivating reality through the unparalleled expertise of IIFL Finance. With a penchant for excellence and a commitment to customer satisfaction, IIFL Finance stands as a beacon of opulence in the landscape of home loans in India. Guiding countless individuals towards the pinnacle of achievement, their bespoke loan offerings are crafted to harmonize with diverse needs and financial circumstances, ensuring that the dream of owning a home transcends into a seamless reality. This article unfolds the exquisite tapestry of IIFL Finance home loans, adorned with exquisite features, unparalleled benefits, meticulous eligibility criteria, and a streamlined application process, setting a new standard of grandeur in the domain of homeownership.

Key Features of IIFL Finance Home Loans

1. Competitive Interest Rates:

IIFL Finance exudes sophistication by providing home loans with competitive interest rates that are as dazzling as a rare gem. Their commitment to offering attractive interest rates sets a tone of opulence, ensuring that borrowers can embrace the luxury of owning a home without the burden of excessive financial strain. With IIFL Finance's esteemed services, homeowners can bask in the comfort of managing their monthly EMIs effortlessly, creating a lifestyle of elegance and financial stability. Aspiring homeowners can trust in the allure of IIFL Finance's home loans, where affordability meets extravagance, to manifest their dreams with a touch of refinement.

2. Flexible Loan Amounts:

Indulge in the boundless possibilities of upscale living with IIFL Finance's exquisite range of home loans tailored to your every desire. From the most modest amounts to opulent sums fit for grandeur, our discerning approach ensures that individuals of refined taste can effortlessly acquire properties of every scale and value. Elevate your lifestyle to new heights with the seamless flexibility we offer, providing you with the means to turn your dream of luxury living into a captivating reality. Experience the epitome of sophistication and elegance as you make every vision of a lavish abode a breathtaking masterpiece with IIFL Finance by your side.

3. Extended Tenure:

Extended tenure in home loans offers a luxurious and liberating experience for borrowers, providing a realm of financial flexibility and convenience. With repayment tenures stretching graciously over 20-30 years, individuals are granted the exquisite privilege of selecting a repayment plan that harmoniously resonates with their unique financial circumstances. This grandeur allows borrowers to meander through time, sculpting their repayment journey with sophistication and ease, ensuring a regal and comfortable balance between their financial responsibilities and personal aspirations. Such an opulent feature uplifts the essence of borrowing, transforming it into a lavish affair of choice and empowerment, guiding borrowers towards a life of financial abundance and graceful repayment structures.

4. Minimal Documentation:

With an emphasis on seamless service and uncomplicated procedures, IIFL Finance sets a distinguished standard by prioritizing a hassle-free loan application process that embraces minimal documentation. By streamlining the journey from application to approval and disbursement, this financial institution ensures not only efficiency but also a touch of luxury in its services. The straightforward and expedited approach adopted by IIFL Finance sets a precedent for a truly client-centric experience, where the focus lies not on paperwork but on swift, tailored solutions that cater to the needs of each individual. By eliminating unnecessary barriers and complexities, IIFL Finance exudes an air of exclusivity in its dedication to providing a stress-free and expedited lending process, redefining the very essence of financial ease and sophistication.

5. Balance Transfer Facility:

Elegantly catering to the refined needs of astute borrowers, IIFL Finance unveils its prestigious Balance Transfer Facility, a gleaming opportunity for those discerning individuals seeking to transcend their current mortgage shackles. With an air of sophistication and exclusivity, this offering showcases competitive interest rates that exude opulence and minimal processing fees that whisper of unparalleled class. Embrace the grandeur of seamless financial transitions and step into a realm where elegance meets efficiency with IIFL Finance's Balance Transfer Facility, a symbol of refinement in the realm of home loan solutions.

6. Top-Up Loans:

Indulge in the exquisite convenience and opulence of top-up loans, a distinguished offering available exclusively to our esteemed existing home loan patrons. Elevating your financial prowess to new heights, top-up loans grace you with the royal privilege of securing additional funds for an array of lavish pursuits, be it the grandeur of home renovation, the refinement of educational endeavors, or the imperative touch of luxury in managing unforeseen medical expenses. With a touch of sophistication, these loans seamlessly blend seamlessly with your existing loan, ensuring a seamless and dignified process that epitomizes your distinguished status as a discerning connoisseur of financial finesse. Embrace the allure of top-up loans and elevate your financial journey towards boundless prosperity and refined sophistication, where each need is met with grace and each dream is realized with elegance.

Benefits of Choosing IIFL Finance Home Loans

1. Quick Processing:

Experience the epitome of seamless financial transactions with IIFL Finance, where swift loan processing and disbursement are meticulously woven into the tapestry of your home buying journey. Picture a world where delays are but a distant memory, and funds flow towards you with the elegance of a well-rehearsed symphony. With IIFL Finance, your aspirations for a new home soar unhindered by sluggish paperwork or cumbersome procedures, allowing you to revel in the luxury of prompt access to the resources you need. Welcome to a realm where time bends to cater to your desires, where each step towards your dream home is met with the efficiency and grace befitting a true connoisseur of life's finer offerings.

2. Customer Support:

Delightful patrons, rest assured that our esteemed establishment boasts nothing short of an exquisite customer support framework meticulously crafted to cater to your every need throughout your illustrious loan tenure. Our devoted teams stand ready at all times, adorned with knowledge and grace, to attend to any inquiries you may have, granting you the privilege of unrivaled guidance in all matters concerning your esteemed loan affairs. With a touch of elegance and finesse, our exceptional support epitomizes a standard of service deserving of admiration and admiration, ensuring that your journey with us is nothing short of opulence and sophistication.

3. Transparency:

In the realm of financial elegance and sophistication, IIFL Finance stands as a beacon of transparency and unwavering integrity. With a commitment to providing a seamless borrowing experience, this distinguished institution takes pride in its crystal-clear dealings, devoid of any obscure charges or undisclosed terms. Embracing a lavish approach to trustworthiness, IIFL Finance ensures that borrowers bask in the radiant glow of complete awareness regarding their loan commitments. Like a shimmering diamond in the realm of finance, IIFL Finance shines brightly with its opulent dedication to clarity and honesty, setting the stage for a truly luxurious borrowing journey where transparency reigns supreme.

4. Customized Solutions:

Indulge in the opulence of tailored financial solutions designed to meet your every need with IIFL Finance's exquisite customized home loan offerings. Luxuriate in the experience of having your dream home within reach, thanks to the meticulously crafted loan solutions meticulously curated for first-time buyers, discerning homeowners in search of an upgrade, or individuals yearning to refinance their existing loans. Revel in the unparalleled service and attention to detail that accompanies each tailored loan package, ensuring that your unique requirements and aspirations are carefully woven into the fabric of your loan journey. With IIFL Finance, the epitome of sophistication and elegance meets the realm of personalized financial solutions, creating an experience that transcends mere transactions, elevating your path to homeownership to an unprecedented level of refinement and luxury.

Eligibility Criteria for IIFL Finance Home Loans

1. Age:

We kindly request that all esteemed applicants fall within the distinguished age range of 21 to 65 years, as we aim to curate a sophisticated collective of individuals. This esteemed age bracket ensures a blend of youthful vigor and seasoned wisdom, embodying the perfect harmony for our esteemed endeavors. In aligning with our commitment to excellence, we seek those who have embraced the richness of experience while retaining the vitality of youth. May this elegant age requirement serve as a testament to the caliber of individuals we aspire to welcome into our esteemed circle of individuals of refined taste and discerning sensibilities.

2. Income:

Ah, income, the elegant foundation upon which a life of opulence is built! A steady source of income, be it a generous salary from a prestigious corporation or the fruit of one's entrepreneurial endeavors, is not merely requisite but a testament to one's financial sophistication and unwavering capability to honor debts. It is the shimmering jewel in one's crown of financial stability, radiating confidence and affluence. A loan, darling, is but a mere trifle when one possesses a flourishing income stream, beckoning lenders with promises of timely repayments bathed in the golden glow of prosperity. It is through the lens of one's income that the true essence of financial trustworthiness and responsibility gleams, casting a radiant aura of reliability upon those fortunate enough to possess it. So, let income be your faithful companion on the journey towards loan approval, a treasured companion indeed in the grand tapestry of financial abundance.

3. Credit Score:

Having a stellar credit score is the pinnacle of financial sophistication, dear reader. It opens the doors to a realm where loan approval is virtually guaranteed, and the terms offered are nothing short of luxurious. Picture yourself effortlessly securing the loan you desire, with bankers vying to cater to your every whim thanks to your impeccable credit history. Your financial aura radiates trustworthiness and responsibility, paving the way for you to indulge in the most favorable loan terms like a connoisseur selecting the finest wine. A good credit score is more than a number; it is the key that unlocks a world of opulent opportunities and ensures that your financial journey is nothing short of lavish.

4. Employment History:

When delving into the realm of employment history, one must understand the paramount significance it holds in the eyes of discerning employers. For the esteemed individuals who revel in the comfort of salaried positions, maintaining a stable employment history is akin to nurturing a rare and exquisite gem – a testament to loyalty, dedication, and unwavering commitment. The roadmap of one's career must be paved with consistency and unwavering reliability, like the steady beat of a metronome in a grand symphony. Conversely, for the enterprising souls who navigate the vast seas of entrepreneurship, a consistent business track record encapsulates the essence of mastery and finesse. Each venture, each triumph, and even the occasional setback, carve a narrative of resilience and acumen upon the annals of commerce. As the curtain rises on the stage of potential opportunities, those with a well-crafted employment history possess the golden ticket to captivate and enthrall prospective employers with their tale of professional fortitude and prosperous endeavors.

Application Process

1. Application Submission:

Indulge in the convenience and elegance of applying for your dream home loan effortlessly with IIFL Finance. Elevate your experience by choosing to either luxuriate in the opulence of our online platform, where you can fill out the home loan application form from the comfort of your own abode with just a few clicks, or bask in the richness of personal service by visiting a nearby IIFL Finance branch where our attentive professionals will attend to your every need. Embrace the sophistication and ease of securing your future with a home loan application process that exceeds expectations and suits your refined taste for excellence.

2. Documentation:

Ensure your ascension to opulence by meticulously presenting the required documentation. Elevate your stature with a regal touch as you submit the exquisite quartet: identity proof, address proof, income proof, and property-related documents. Let each document resonate with magnificence and grandeur, reflecting your esteemed position in the realms of privilege and prosperity. As you partake in this noble endeavor, remember, each parchment is a testament to your exalted status and serves as a shimmering key to unlock the gates of distinction. Embrace this dignified process with grace and poise, for it is through these prestigious documents that your legacy of luxury shall be immortalized.

3. Loan Processing:

Ah, the intricate dance of loan processing – a symphony of meticulous evaluation and discerning consideration. As the loan application gracefully makes its way to IIFL Finance's capable hands, a grand performance unfolds. With unparalleled expertise and refined precision, IIFL Finance delicately examines the applicant's eligibility, unraveling the intricacies of their financial profile. Like a skilled artisan crafting a masterpiece, the loan amount is meticulously curated, ensuring a harmonious balance between what is sought and what is attainable. With every detail scrutinized with utmost care and finesse, IIFL Finance orchestrates a seamless symphony of loan processing, turning the applicant's aspirations into a luxurious reality.

4. Approval and Disbursement:

Upon the gracious approval bestowed upon you, the loan amount is elegantly sanctioned and disbursed, like a budding flower unfurling its petals with grace. This enchanting moment allows the esteemed borrower to embark on their journey of acquiring a new home, setting the stage for opulence and grandeur to unfold. With every step taken towards this home purchase, a symphony of prosperity and refinement resonates through the air, marking the beginning of a chapter filled with sophistication and luxury. Embrace this moment with poise and splendor, for the doors to your dream abode have swung open, welcoming you with open arms into a realm of unparalleled magnificence.

Conclusion

Embark on the opulent journey towards homeownership with the illustrious IIFL Finance home loans, crafted to uplift and support aspiring homeowners across the enchanting landscape of India. Delicately designed to exude accessibility, affordability, and unparalleled flexibility, these divine financial solutions beckon you to embrace the pinnacle of luxury living. Bask in the radiance of competitive interest rates, where each glimmer reflects a promise of prosperity and success. Wrapped in the finest cloak of personalized service, IIFL Finance adorns you with a crown of bespoke financial solutions, catered exclusively to your regal aspirations. With a noble commitment to transparency, IIFL Finance emerges as the steadfast beacon guiding you through the enchanting realms of homeownership. Whether you are a fledgling knight seeking the keys to your first castle or a seasoned noble yearning to adorn your current abode with grandeur, rest assured that IIFL Finance's divine embrace shall provide the royal financial backing required to turn your homeownership dreams into shimmering reality.

0 Comments